COMMUNITY REINVESTMENT ACT NOTICE

Under the Federal Community Reinvestment Act (CRA), the Federal Deposit Insurance Corporation (FDIC) evaluates our record of helping to meet the credit needs of this community consistent with safe and sound operations. The FDIC also takes this record into account when deciding on certain applications submitted by us.

Your involvement is encouraged.

You are entitled to certain information about our operations and our performance under the CRA, including, for example, information about our branches, such as their location and services provided at them; the public section of our most recent CRA Performance Evaluation, prepared by the FDIC. You may also have access to the following additional information, which we will make available to you at this location within five calendar days after you make a request to us: (1) A map showing the assessment area containing this branch, which is the area in which the FDIC evaluates our CRA performance in this community; (2) data on our lending performance in this assessment area; and (3) copies of all written comments received by us that specifically relate to our CRA performance in this assessment area, and any responses we have made to those comments. If we are operating under an approved strategic plan, you may also have access to a copy of the plan.

At least 30 days before the beginning of each quarter, the FDIC publishes a nationwide list of the banks that are scheduled for CRA examination in that quarter. This list is available from the Regional Director, Division of Depositor and Consumer Protection, FDIC 1100 Walnut Street, Suite 2100, Kansas City, MO 64106.

You may send written comments about our performance in helping to meet community credit needs to Vantage Bank PO Box 51, 202 Main Street, Kent, MN 56553 and FDIC Regional Director. Your letter, together with any response by us, will be considered by the FDIC in evaluating our CRA performance and may be made public.

You may ask to look at any comments received by the FDIC Regional Director. You may also request from the FDIC Regional Director an announcement of our applications covered by the CRA filed with the FDIC. We are an affiliate of MinnDak Bancshares, Inc., a bank holding company. You may request from the Officer in Charge of Supervision, Federal Reserve Bank of Minneapolis, 90 Hennepin Avenue, Minneapolis, MN 55401 an announcement of applications covered by the CRA filed by bank holding companies.

VANTAGE BANK

PO Box 51 – 202 South Main Street

KENT, MN 56553

COMMUNITY REINVESTMENT ACT STATEMENT

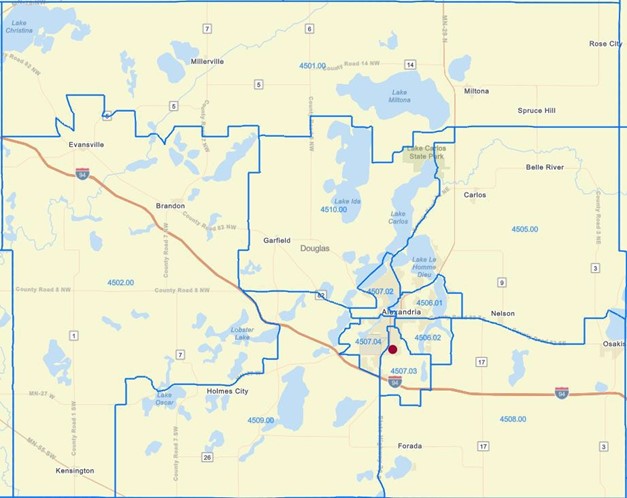

Vantage Bank with its main office located at P O Box 51 – 202 South Main Street Kent, MN 56553, Census Tract 9501 and branch office located at 311 30th Ave E, Alexandria, MN 56308, Census Tract 4507.03 ADOPTS AND PUBLISHES THIS Community Reinvestment Act Statement in compliance with the Federal Community Reinvestment Act (CRA).

The bank seeks to meet the credit needs of individuals and firms living and doing business within its community and delineated by the attached maps.

COMMUNITY REINVESTMENT ACT ASSESSMENT AREA includes the Census Tract (CT) numbers 9707, 9708, 9709 and 9710 in Richland County North Dakota and CT number of 9501 and 9502 for Wilkin County Minnesota and 4501, 4502, 4505, 4506.01, 4506.02, 4507.02, 4507.03, 4507.04, 4508, 4509, 4510 of Douglas County Minnesota.

The bank seeks to meet the credit needs of individuals and firms living and doing business within its assessment area by making the following types of loans available to qualified borrowers on the basis of demonstrated proper purpose and borrower qualifications:

- 1 to 4 family residential properties

- Multifamily (5 or more) residential properties

- Farm land including farm residential properties

- Business and industrial properties

- Farm loans for the purchase of machinery and equipment, livestock, crop production, and other capital requirements

- Business loans for the purchase of machinery and equipment, furniture, fixtures, inventory and other capital requirements

- Consumer loans for vehicles, mobile homes, recreational equipment, other consumer goods and unsecured loans

- Community development loans

- Safe Deposit Boxes

- DDA (checking)

- Savings accounts

- Market rate deposit accounts

- Certificates of deposit accounts

- IRA

Fees and rates are reflected on FEE SCHEDULE.

The bank currently participates in and will continue to participate in a broad range of community-based programs designed to meet the credit needs of its local community through credit services, direct personal involvement of its employees, and cooperation with community officials and agencies.

Main Bank – 202 Main Street, Kent, MN

Hours: Lobby: 9:00am to 4:00pm Monday through Fridays

Branch Bank – 311 30th Ave E, Alexandria, MN

Hours:

Drive Thru: 7:30am to 5:00pm Monday through Fridays 9:00am to 12:00pm

Saturdays (non-business day)

Lobby: 8:00am to 5:00pm Monday through Fridays

*24-hour Internet Banking is available at www.vantagebankmn.com

*ATM with 24-hour accessibility (non-depository) located in the drive thru of the Alexandria Branch

Kent Market

CRA Assessment Area

Census Tracts:

Richland County ND 9707

9708

9709

9710

Wilkin County ND

9501

9502

Alexandria Market

CRA Assessment Area

|

Census Tracts: |

|

|

4501 |

4502 |

|

4505 |

4506.01 |

|

4506.02 |

4507.02 |

|

4507.03 |

4507.04 |

|

4508 |

4509 |

|

4510 |

|